- 2577

- 2

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

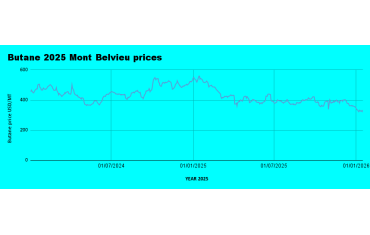

Weekly Mont Belvieu Propane-Butane Price Review: January 10th, 2025

Weekly Mont Belvieu Propane-Butane Price Overview: January 10th, 2025

Here’s a summary of this week’s LPG price trends, with daily average prices for propane and butane:

06/01/2024: Propane $456.7 / Butane $543.2

07/01/2024: Propane $449.5 / Butane $531.3

08/01/2025: Propane $449.5 / Butane $523.9

09/01/2025: Propane $448.4 / Butane $518.7

10/01/2025: Propane $456.5 / Butane $526.3

Weekly Price Trends for Propane and Butane

LPG prices this week reflected varying market dynamics, with propane maintaining an upward trajectory and butane experiencing a slight decline compared to the previous week's averages.

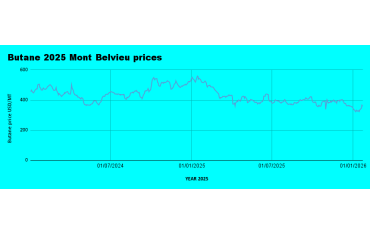

Propane Prices:

Propane prices averaged $452.1 per metric ton, a 5.1% increase from last week's average of $430.2.

Propane prices strengthened significantly, with a consistent upward trend.

The weekly high was $456.7 on January 6, reflecting robust heating demand in key markets.

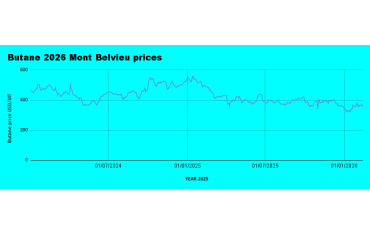

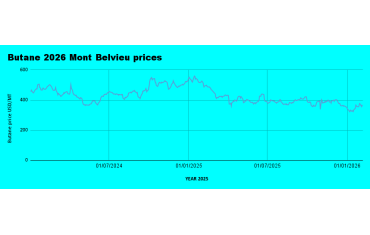

Butane Prices :

Butane prices averaged $528.7 per metric ton, a 2.3% decline from last week’s average of $541.1. It experienced a modest but steady decline, with the weekly low at $518.7 on January 9. The price drop reflects a combination of seasonal demand softening and improved supply availability.

Market Drivers include:

Weather Influence—Increased propane demand for heating contributed to its price rise, while improved logistics and higher shipments or supplies likely offset demand pressure on butane prices.

Looking ahead, Propane Prices may continue to rise if colder weather persists or if supply disruptions occur, while Butane Prices are expected to stabilize as the market adjusts to seasonal changes in demand.

Weekly crude oil market analysis :

Oil prices have kicked off 2025 with a strong rally, with Brent surpassing $80 per barrel for the first time since October 7, 2024. Crude oil prices closed the week at $77.46 and $80.36 per barrel for WTI and Brent respectively, against the previous close of 73.27 and 76.02 per barrel in the previous week; a weekly increase of 5.7% for both; signifying an aggressive start to the year.

Price drivers include, sanctions by the Biden administration on Russia have added upward pressure on prices by tightening supply dynamics, the unusually cold weather across the Atlantic Basin, which has spurred higher heating oil demand and demand optimism based on China’s economic recovery, bolstered by recent fiscal stimulus measures.

Outlook:

The price rally reflects a bullish turn in crude markets, driven by a combination of supply-side constraints and demand-side optimism.Higher oil prices could incentivize increased production from non-OPEC+ players, potentially balancing supply-demand dynamics in the medium term. Prices are expected to remain firm as the market reacts to geopolitical developments, weather conditions, and China’s demand trajectory. Upcoming OPEC+ meetings and further updates on U.S. and Russian sanctions will remain pivotal for market direction.

Nigerian LPG Depot Prices defies international prices

In a week where butane prices averaged 541 USD/MT, depot prices in Nigeria exhibited unusual behaviour; dropping further and selling as low as 21.1 Million per 20MT in Apapa and 22.6 Million per 20MT in the South- South. Prices made no sense compared to the landing cost when international LPG prices, freight rate, throughput charge, and Foreign Exchange rates amongst several factors . Reports, suggest Dangote prices as the reason for the market disruption, others argue that the volumes from Dangote aren't enough to disrupt the market. However, the market is just waking up from the holidays and demand may not be at optimal levels; so prices are likely to adjust upwards to meet as the market wakes up.

Retail Prices drop further

Retail LPG prices also dropped further. In Lekki, LPG sold for 15,250 Naira per 12.5kg cylinder, a drop from N16,500 it sold last week .

Visit the LPG forum to share local Retail prices and participate in the discussion.

2 Comments.

-

-

Tony

12 January 2025 - 08:14amThank you Godwin. The potential Dangote effect on local prices of LPG is evident that a truly free enterprise market drives competition and roots out exploitation of the market by a few. Hopefully, the market will welcome more capable investors who will compete and eventually free the market from the monopolistic conspiracy of government officials and a few private investors.

Reply

Ehi Okoduwa

12 January 2025 - 07:11pmThank you. The market has largely been market-driven since 2007 and has been deregulated for a longer time, with no manipulation from the Government, but rather support.

Reply