- 2862

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

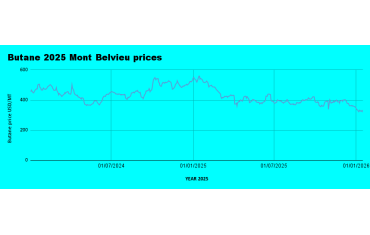

Weekly Mont Belvieu Propane-Butane Price Review: December 20th, 2024

Weekly Mont Belvieu Propane-Butane Price Overview: December 20th, 2024

Here’s a summary of this week’s LPG price trends, with daily average prices for propane and butane:

16/12/2024: Propane $400.8 / Butane $500.0

17/12/2024: Propane $400.2 / Butane $504.5

18/12/2024: Propane $400.4 / Butane $500.8

19/12/2024: Propane $391.7 / Butane $499.7

20/12/2024: Propane $394.0 / Butane $503.0

LPG Prices Show slow changes in movement

Comparing the provided data with the previous week’s performance reveals slight volatility in LPG prices, with varying trends for propane and butane:

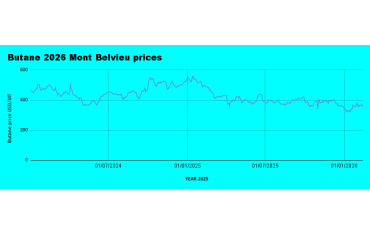

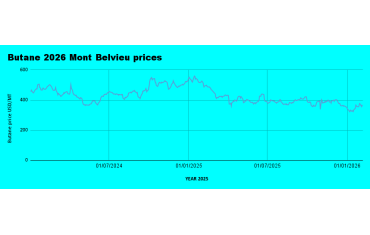

Butane Prices

Weekly Average: $501.6 per metric ton, a 1.0% increase from the previous week's $492.2.

Butane prices fluctuated, peaking at $504.5 on December 17 before stabilizing around $500 toward the week’s end.

Trend: A mild bullish trend, indicating steady demand or market constraints.

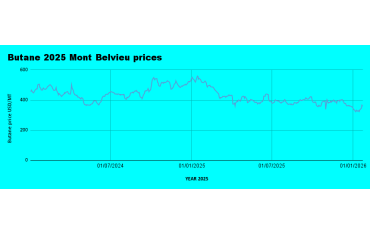

Propane Prices

Weekly Average: $397.4 per metric ton, a 0.9% decline from the previous week's $400.0.

The price started the week steady around $400 but dropped sharply to $391.7 on December 19 before slightly recovering to $394.0 on December 20.

Trend: A generally bearish trend, suggests weaker demand or increased supply pressures.

Key Observations

Price Divergence: Propane exhibited a downward trend, while butane experienced a slight upward movement, highlighting differing market dynamics for the two LPG components.

Market Stability: Both commodities showed limited volatility, with daily price changes within a narrow range.

Potential Drivers: The dip in propane prices might be attributed to softer demand or ample supply, whereas butane's resilience could signal stronger seasonal demand or tighter availability. We think Butane prices are losing steam from our end and may go bearish soon.

Weekly Crude Oil Market Analysis: Bearish Sentiment Intensifies

WTI and Brent crude posted notable declines, reflecting bearish sentiment driven by weak demand outlooks, oversupply, and macroeconomic concerns. Unless new supportive factors emerge, the market may remain under pressure as the year closes.

WTI Crude: Closed at $69.1 per barrel, a 2.3% decline from the previous week’s $70.73.

Brent Crude: Ended at $72.6 per barrel, down 1.9% from the previous week’s $74.0.

Both benchmarks recorded their second consecutive weekly decline, underscoring the market’s pessimism as the year draws to a close.

The U.S. Federal Reserve’s announcement of maintaining higher interest rates for a prolonged period has weighed heavily on oil markets. Higher rates strengthen the U.S. dollar, reducing crude oil's attractiveness to non-dollar buyers and curbing global demand.

This comes at a time when global economic growth remains fragile, with fears of a slowdown in key economies like the U.S. and EU further dampening sentiment.

China, the world’s second-largest oil consumer, continues to struggle with weaker-than-expected economic recovery.

Reports suggest a shift towards electric vehicles (EVs) and increased use of alternative energy sources, which could be limiting crude oil demand growth.

Oversupply Pressures:

Non-OPEC+ producers, particularly in the U.S., have ramped up production, adding to global supplies.

OPEC+ has yet to announce additional production cuts, leaving the market oversupplied and reinforcing the bearish outlook.

Muted Geopolitical Impact:

Ongoing tensions in regions like Ukraine and the Middle East have had limited influence on oil prices, as markets increasingly focus on demand and supply fundamentals over geopolitical risks.

Traders will be watching for signals from OPEC+ ahead of their next meeting, economic data from China, and any shifts in U.S. monetary policy.

Potential for Further Declines: Without a positive catalyst, crude prices could face continued downward pressure.

Nigerian LPG Depot Prices See Modest Increase

Depot prices for LPG edged slightly higher last week. In Lagos, prices hovered around 23 million Naira per 20 MT, while the South-South region sustained higher prices, with Shafa, Prudent Energy, and Stockgap depots selling at approximately 24 million Naira. Dangote continued to offer lower rates, pricing at 22.4 million Naira per 20 MT, below the market average.

Retail Prices Remain Steady

Retail LPG prices held stable nationwide, supported by adequate market supply. In Lekki, LPG sold for 17,500 Naira per 12.5kg cylinder.

Visit the LPG forum to share local Retail prices and participate in the discussion.

- Lpg

- Butane

- Propane

- Lpgprices

- Nigerialpg

- Weeklylpg

- Lpgtrend

- Us

- China

- Opec

- Lpgweekly

- Nigeriadepot

- Nigerialpgprices

0 Comment.