- 3169

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

Weekly Mont Belvieu Propane-Butane Price Review September 15th 2023

Weekly Mont Belvieu Propane-Butane price review September 15th, 2023

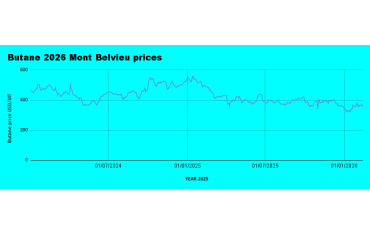

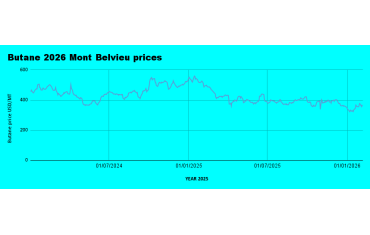

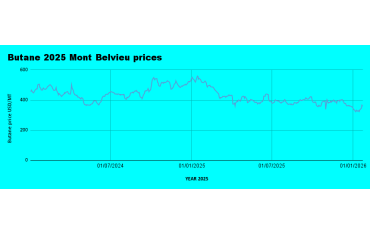

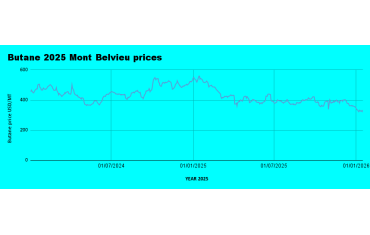

Our assessment for last week's daily Mont Belvieu propane and butane in USD/mt (4.9% and 3.3% up respectively on the weekly average):

11th September: 396.9; 413.2

12th September: 409.6; 421.3

13th September: 402.0; 416.2

14th September: 407.2; 422.7

15th September: 402.5; 421.0

The Bullish trend with LPG prices doesn't seem to be slowing down. Both Butane and propane prices finished the week higher; 3.3% and 4.9 % higher respectively.

The current oil price rally shows no signs of slowing down, and it is primarily being fueled by a combination of factors that are driving market optimism; Oil production cuts by major oil producers (OPEC+) and the Chinese demand resurgence.

China's robust refinery runs and strong demand for oil have contributed to a growing sense of optimism within the oil industry. Despite challenges faced by Europe and the United States due to refinery maintenance issues, the soaring demand from China has more than compensated for these setbacks.

The dynamic interplay of these factors has created an environment where the oil price rally appears relentless, offering exciting opportunities and challenges for market participants. We can predict that the price trend is bullish unless something unexpected happens.

Local LPG prices in Nigeria

Historic Highs in Apapa:

In an unprecedented turn of events, local depot prices in Apapa have surged to an all-time high, reaching a staggering 14 Million Naira. This milestone marks a pivotal moment in the industry, reflecting the complex dynamics at play in the energy market.

Regional Disparities in LPG Availability:

While Apapa faces these record-high prices, it's noteworthy that Port Harcourt experienced limited or no availability of LPG. In contrast, the South-South region saw prices dip below the 14 Million Naira mark, with Kwale Hydrocarbon leading the way at 13.3 Million Naira per 20 metric tons. These regional variations underscore the intricate supply-demand balance at work.

FX Rate Volatility and LPG Prices:

The Nigerian Naira's continuous fluctuation in the foreign exchange (FX) market has exacerbated the pressure on LPG prices. It's worth noting that over 50% of LPG consumed in Nigeria is imported. The ever-changing Naira/FX rate has a direct impact on the cost structure of imported LPG, amplifying the challenges in maintaining price stability.

Retail Prices Respond Swiftly:

In response to these dynamics, retail prices of cooking gas have reacted swiftly and have now exceeded the 10,000.00 Naira mark for a 12.5kg cylinder in most areas across the country. This escalation places a significant financial burden on consumers and underscores the need for a comprehensive industry strategy to address pricing concerns.

The LPG market in Nigeria continues to navigate through intricate challenges, including supply-chain disruptions, currency volatility, and regional disparities. As a trusted stakeholder in this sector, we remain committed to keeping you informed of these evolving developments and their implications for your business and investments.

Should you require further analysis or have specific questions regarding these developments, please do not hesitate to reach out. We are here to provide the insights and guidance you need to navigate this dynamic market effectively.

- Lpg

- Lpgprices

- Butane

- Propane

- Nigeria

- Lpgdepotprices

- Nigeriadepotprices

- Priceincrease

- Lpgtanks

- Lpgequipment

- Lpgconsultancy

0 Comment.