- 3800

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

CBN POLICY: New Naira Notes And LPG Purchase In Nigeria

The CBN Governor, Godwin Emefiele, on October 26, 2022, announced that new naira notes would be introduced to replace the current 200, 500, and 1,000 notes, the apex bank also gave tomorrow, Tuesday, January 31, 2023, as the deadline for phasing out the old versions of the affected naira notes. Nigerians, banked or unbanked, are racing against time to rid their purses and wallets of old N200, N500 and N1,000 notes, following the Central Bank of Nigeria (CBN) on phasing them out as the country’s legal tender on January 31, 2023. But the redesigned notes meant to replace the old ones are yet to be seen or felt by a vast number of citizens. Investigations show that part of the reasons the new notes are not in circulation is that the commercial banks take money from certain politicians, fraudsters as well as money vendors and give them the new notes, which should have been stocked in their ATMs. It was also learnt that the banks use the new naira notes to compensate and reward their mega customers.

One might wonder how this new note policy affects the LPG industry, the answer might also be a question in the context of asking - what part of everyday Nigerian life isn’t affected by cash and commodity purchase? The average Nigerian for the past two weeks has had difficulty purchasing goods and services with old Naira notes owing to the current upheaval by the Central Bank of Nigeria on the deadline for old Naira note usage. The problem as mentioned above is the lack of circulation of these new Naira notes. However, when we look closely at the effect of this new policy on citizens – it is necessary to divide it into two broad parts namely: ‘the banked’ and ‘the unbanked’.

The reason for adopting this phrase is that it can be considered the best way to describe the broad difference between Nigerians in general, especially Lagosians who are our primary focus, as we cannot speak for every Nigerian in different parts of the country.

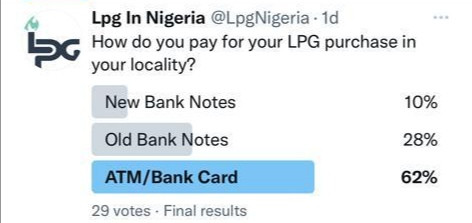

The Banked Nigerians: Banked Nigerians are those who have access to financial institutions, understand the workings of these financial institutions and make use of them to their advantage. These Nigerians are well-documented financially, they have their BVN, NIN, Bank Apps and ATMs at their disposal and can transact at their convenience anytime and anywhere. For these set of Nigerians in present-day Nigeria, they can carry out certain commercial activities like paying for goods and services without the use of cash via transfer, or ATM payments. This is a relief for them as they are also affected by the lack of circulation of new Naira notes. LPG in Nigeria carried out a short survey asking how our readers and followers paid for their LPG purchases in their locality. About 10% said they paid with new notes; 28% with old notes and 62% with ATM/Bank Cards. Thus, the most likely way for consumers to purchase LPG in their locality is with their Bank cards and ATMs.

The Unbanked Nigerians: Unbanked Nigerians are those Nigerians with little or no access to financial institutions. These Nigerians are undocumented in the financial database of the country, they mostly do not have their BVN, NIN, Bank Apps and ATMs. They do not have an understanding of how the system works, are ‘suspicious’ of banks and keep their cash to themselves. We are talking about the rural populace of the country, petty traders etc. It is sometimes surprising to find that this set of Nigerians also exists in urban regions of the country. Take, for example, Lagos, the metropolis of Nigeria – areas like Agegunle, inner parts of Ikorodu, Adeniji and Lagos Mainland are plagued by unbanked Nigerians. They have access to financial institutions but are resistant towards them. They are the ones who are most affected by this change by CBN. It is difficult for them to make their everyday purchase alongside other necessities like LPG due to their lack of accessibility to financial institutions.

Upon closer look, there is still a large financial gap in the country between banked and unbanked Nigerians. Financial education is needed for suburban and rural Nigerians to have easy access to purchase necessities. Finally, as of 29th of January, 2023, CBN extended the deadline from 31st to 10th of February, 2023.

Source:

The Guardian News Article by Chijioke Iremeka.

0 Comment.