- 767

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

How Flare Gas Commercialisation Is Reshaping Nigeria’s LPG Future

For decades, gas flaring has been one of the most visible paradoxes of Nigeria’s energy sector: vast quantities of valuable natural gas burned off daily in oil-producing regions, while households and businesses struggle with high energy costs and limited access to clean fuels. Today, that paradox is beginning to change. Recent advances in flare gas commercialisation mark a turning point, one with profound implications for Liquefied Petroleum Gas (LPG) in Nigeria.

Gas flaring occurs when associated gas produced alongside crude oil is burned because it cannot be economically captured or transported. Nigeria has historically ranked among the world’s highest gas-flaring countries, losing billions of dollars’ worth of energy annually and emitting significant greenhouse gases. In response, the Nigerian government has intensified efforts to end routine flaring through structured programmes such as the Nigerian Gas Flare Commercialisation Programme (NGFCP). Recent milestones, including the issuance of flare gas commercialisation permits to multiple private investors, signal that Nigeria is moving beyond policy statements into actual implementation. These projects aim to capture gas that was previously wasted and convert it into usable products such as power, compressed natural gas (CNG), and crucially, LPG. This shift aligns with Nigeria’s broader “Decade of Gas” agenda and global climate commitments, but its most immediate impact may be felt much closer to home, inside Nigerian kitchens and small businesses.

What This Means for LPG in Nigeria

From our perspective as stakeholders in Nigeria’s LPG market, flare gas commercialisation presents both an opportunity and a potential structural reset.

First, it promises increased domestic LPG supply. Flare gas often contains propane and butane, the key components of LPG. Capturing and processing this gas can significantly boost local LPG production. For a country that still imports a notable portion of its LPG despite having abundant gas reserves, this is a strategic advantage. Increased domestic supply can reduce exposure to international price volatility, shipping costs, and foreign exchange pressures.

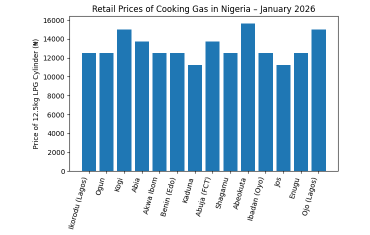

Second, it supports price stability and affordability. While LPG prices in Nigeria are influenced by many factors, logistics, infrastructure, and policy among them, supply constraints remain a major driver of price spikes. As flare gas projects come onstream, they can help smooth supply gaps, particularly during periods of high demand. Over time, a more reliable supply base could make LPG a more predictable and affordable cooking fuel for households.

Third, it strengthens the clean cooking agenda. Nigeria continues to battle widespread energy poverty and heavy dependence on biomass fuels such as firewood and charcoal. Expanding LPG availability through flare gas utilisation directly supports the transition to cleaner cooking, with positive impacts on public health, environmental protection, and gender outcomes. For millions of Nigerian households, more LPG in the market could mean cleaner kitchens and safer living conditions.

Beyond supply, flare gas commercialisation has important multiplier effects. Increased LPG production encourages investment across the downstream value chain, storage terminals, bottling plants, cylinder manufacturing, transportation, and retail distribution. This not only deepens market penetration but also creates jobs and stimulates local enterprise. For Nigeria’s LPG industry, this is an opportunity to move from a largely import-supported market to a more self-reliant, domestically anchored ecosystem. It also opens the door for regional LPG supply leadership within West Africa, positioning Nigeria as both a producer and exporter in the medium to long term.

Despite its promise, flare gas commercialisation is not a silver bullet. Infrastructure development, financing, regulatory coordination, and project execution remain critical challenges. Capturing flare gas requires investments in processing facilities, pipelines, and off-take arrangements, without these, permits alone will not translate into LPG volumes.

There is also the question of market alignment. For flare gas-derived LPG to truly benefit Nigerians, supportive policies must ensure efficient distribution, fair pricing, and integration with existing LPG infrastructure. Without this, increased production may not fully translate into improved access for end users.

Flare gas commercialisation represents a rare convergence of environmental responsibility and economic opportunity. For Nigeria’s LPG sector, it is a chance to secure feedstock locally, reduce imports, stabilise prices, and accelerate clean cooking adoption. If implemented effectively, the flames that once symbolised waste and pollution could become a steady source of affordable fuel for Nigerian homes and industries. In many ways, this is a defining moment. Turning flare gas into LPG is not just about energy efficiency, it is about reshaping Nigeria’s energy narrative, one cylinder at a time.

0 Comment.