- 1688

- 2

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

Month-on-month Cooking Gas Average Experiences A Decrease Of About 5.39% For October 2025.

The Nigerian LPG (cooking gas) market continues to reflect the broader instability of the country’s energy ecosystem. While LPG remains one of the most accessible clean-energy options for households, the reality on the ground in October 2025 paints a picture of fluctuating prices, unequal access, and a market still struggling to stabilise under the weight of supply chain inefficiencies.

Across major cities and states, LPG prices differed sharply, revealing the long-standing structural issues that continue to shape Nigeria’s clean-energy transition. Beyond the numbers, October’s price movements underscore a deeper question: Is Nigeria truly ready to build an affordable, clean-energy economy powered by LPG?

This month’s data provides an important window into that question. W e were able to get our data from our social media followers across all our social media platforms and we are indeed grateful for the continuous response.

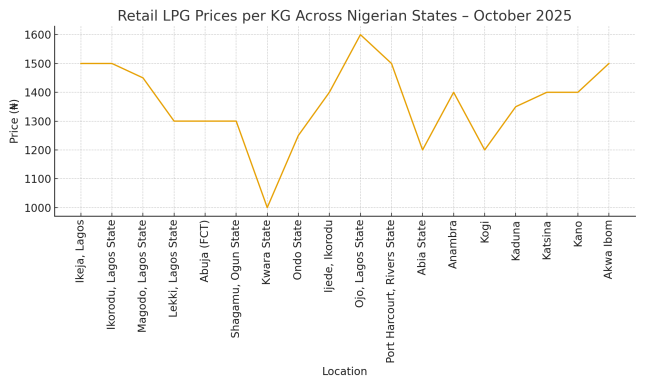

The October 2025 data shows retail prices ranging from ₦1,000 per kg in Kwara to ₦1,600 per kg in Ojo, Lagos. This ₦600 price spread is not simply a matter of location, it reflects the underlying structural gaps in Nigeria’s LPG pricing system.

Below is the summarised price distribution:

Highest Price: Ojo, Lagos

₦1,600 per KG

₦20,000 for 12.5KG

Lowest Price: Kwara State

₦1,000 per KG

₦12,500 for 12.5KG

Lagos’ Internal Inequality

Within Lagos alone, prices ranged widely:

₦1,300 in Lekki

₦1,450 in Magodo

₦1,600 in Ojo

This illustrates how uneven access to terminals, market competition, and transportation dynamics heavily shape LPG affordability, even within a single urban region.

Price Movement: September vs October 2025

In September, the national average retail price of cooking gas stood at ₦18,020, while in October it dropped to ₦17,048. This represents a price difference of ₦972, showing a month-on-month average decrease of about 5.39%.

This decline signals a slight easing in supply pressure across several states, although prices remain uneven due to logistics costs, market competition, and differences in retail infrastructure.

October Price Breakdown

1. The Growing Inequality of Access to Clean Energy

One of the most striking lessons from the October 2025 LPG price data is just how unequally distributed clean energy remains in Nigeria. While urban centres like Lagos and Abuja tend to dominate discussions on energy transition, the lived reality of LPG adoption varies dramatically across regions.

In states like Kwara or Kogi, competition among local dealers and lower transportation costs help keep prices within reach for many households. But in coastal cities like Lagos, ironically closer to the nation’s major terminals, the influence of market speculation, higher operational costs, and urban demand pressures push prices upward.

This pattern reinforces a familiar question:

How can Nigeria achieve clean-energy inclusion when the cost of LPG remains unaffordable for millions?

2. Supply Chain Inefficiencies Continue to Distort Prices

Despite efforts by the government to expand domestic LPG production, the supply chain is still riddled with gaps:

Limited storage facilities

Terminal congestion

Rising transportation and logistics costs

Dealer speculation during periods of tight supply

Heavy reliance on imported LPG

These constraints create a fragile supply chain where any disruption from a ship delay to a pipeline issue instantly affects retail prices.

The result is a volatile market where consumers bear the brunt of inefficiencies beyond their control.

3. The Economic Burden on Households in 2025

With inflation already eroding purchasing power nationwide, spending ₦18,000–₦20,000 to refill a 12.5KG cylinder places significant stress on households.

For a low-income family earning ₦40,000–₦70,000 per month, the cost of cooking gas alone now consumes 30–45% of monthly income.

This pushes many families back to:

firewood

charcoal

kerosene

sawdust briquettes

These alternatives worsen deforestation, air pollution, and public health outcomes, undermining Nigeria’s clean-energy transition goals.

4. Why Inland States Sometimes Offer Cheaper LPG

It seems counterintuitive that states farther from the coast sometimes have lower prices. But this is often due to:

Strong local dealer competition

Proximity to certain inland storage hubs

Lower rental and operational costs

Community-driven price regulation in smaller markets

This dynamic shows that the LPG price landscape is shaped not only by geography, but by regional market forces.

5. What the Future Could Look Like and What Must Change

Nigeria has the potential to become a major LPG-driven clean-energy economy. But to get there, several changes are necessary:

Expand domestic LPG processing

Decrease reliance on imports that expose the market to forex shocks.

Improve storage and distribution infrastructure

Reduce bottlenecks that lead to artificial scarcity.

Introduce transparent, competitive pricing frameworks

Curb speculation and arbitrary dealer mark-ups.

Support households through subsidy-free but targeted relief

For example: voucher systems, credit for cylinders, or pay-as-you-use LPG.

Encourage private sector investment

A freer, more structured market will allow innovation to thrive.

Emmanuel

19 November 2025 - 01:23pmI love the solutions but don't really understand them

Reply