- 2642

- 1

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

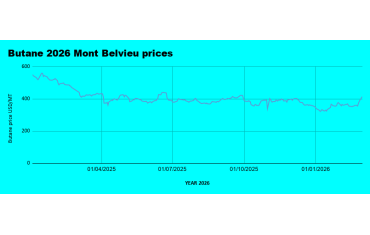

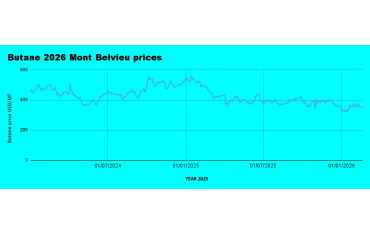

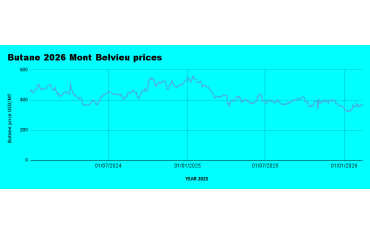

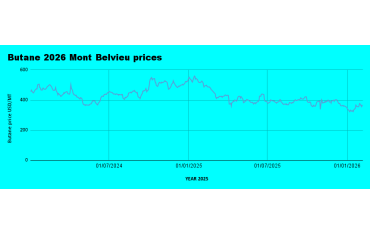

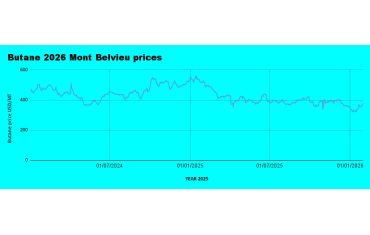

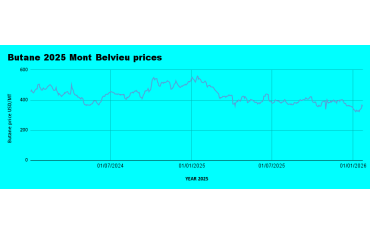

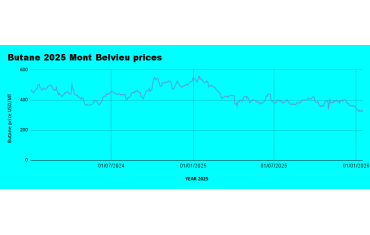

Weekly Mont Belvieu Propane-Butane Price Review October 6th 2023

Our assessment for last week's daily Mont Belvieu propane and butane in USD/mt (2.2.% and 6.8% down respectively on the weekly average):

2nd October: 376.4; 386.6

3rd October: 378.7; 385.2

4th October: 364.9; 368.5

5th October: 357.2; 354.2

6th October: 356.2; 348.5

LPG Prices Under $350 USD:

For the third consecutive week, LPG prices have shown resilience, remaining just below the $400 USD mark. Notably, Butane prices closed below $350 USD for the first time since August, possibly indicating a reversal in the trend. They closed at $348.5 USD/MT compared to the previous week's close of $396.1 USD/MT. Propane prices also registered a significant drop, closing at $356.2 USD/MT, down from $377.1 USD/MT in the previous week. LPG trends have closely followed the trajectory of oil prices, which rebounded after a sustained upward trend.

Oil Price Rebound:

Oil prices have experienced a noticeable reversal in trend, with a close well below $90 USD per barrel from a previous high of over $95 USD per barrel. Energy analysts have attributed this shift to decreased gasoline consumption in the United States, suggesting declining demand for oil and confirming an overbought situation for crude oil prices. In the OPEC arena, Saudi Arabia's decision to avoid further crude oil production cuts has contributed to the recent price decline.

Local LPG Prices in Nigeria:

Depot Scarcity: LPG scarcity continues at the depots, although retail customers are not facing shortages. Notably, the NPSC depot received 5500 MT from Asharami via MT SAPET, marking the first such delivery since 2021 when it temporarily shut down for maintenance. LPG prices peaked at 14.5 million Naira nationwide, with a few selling at around 14 million Naira per 20 metric tons.

Retail Prices: Retail prices of LPG in Nigeria have remained relatively stable. The lowest prices, just below 10,000 Naira for a 12.5kg cylinder in Lagos, with several cities selling at around 11,500 Naira for the same quantity.

We encourage you to register and contribute to our retail price records via our FORUM to help keep our data up to date.

Should you require further analysis or have specific questions regarding these market developments, please do not hesitate to reach out. We provide the insights and guidance you need to navigate this dynamic market effectively.

Thank you for your attention, and we look forward to assisting you with any further inquiries.

Ehi Okoduwa

08 October 2023 - 05:13pmWe expect prices to stabilise or even decrease provided FX rates stabilizes or improves in favor of the Naira.

Reply