- 4773

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

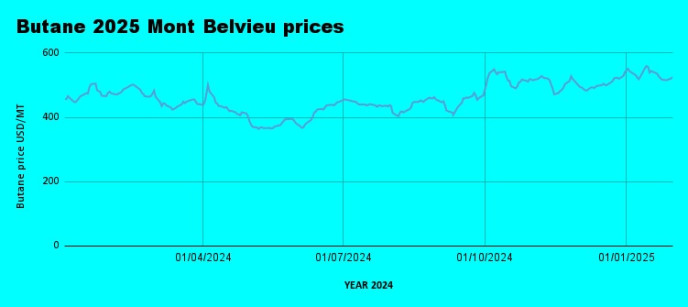

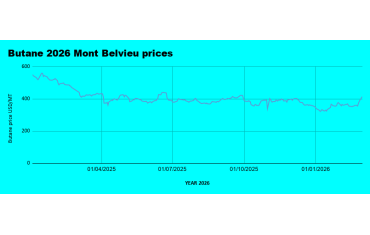

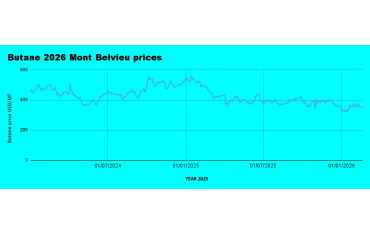

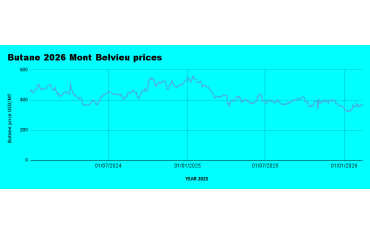

Weekly Mont Belvieu Propane-Butane Price Review: January 31st, 2025

Weekly Mont Belvieu Propane-Butane Price Overview: January 31th, 2025

Here’s a summary of this week’s LPG price trends, with daily average prices for propane and butane:

27/01/2025: Propane $469.1 / Butane $515.7

28/01/2025: Propane $463.0 / Butane $517.1

29/01/2025: Propane $469.1 / Butane $519.8

30/01/2025: Propane $468.1 / Butane $520.7

31/01/2025: Propane $476.1 / Butane $526.0

LPG Price Overview

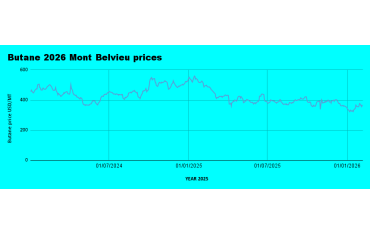

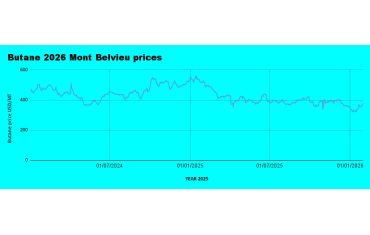

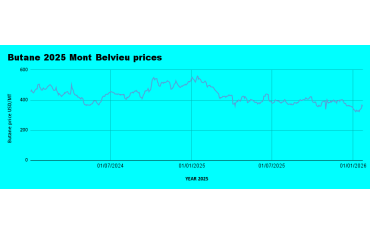

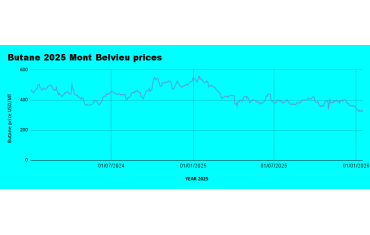

LPG prices exhibited a slight downward trend last week, with propane averaging 469.1 USD per metric ton, marking a 2.9% decline from the previous week’s 483.3 USD per metric ton. Butane, meanwhile, averaged 519.9 USD per metric ton, reflecting a 1.1% decrease from the prior week’s 525.5 USD per metric ton.

Propane opened the week at 469.1 USD, fluctuated slightly, and closed at 476.1 USD on January 31st, while Butane prices remained stable within a narrow range, opening at 515.7 USD and closing at 526.0 USD. Propane’s decline signals weaker seasonal demand, possibly due to milder winter conditions in major consuming regions .Butane prices showed more resilience, supported by steady demand from petrochemical industries.

Propane prices may continue to face downward pressure unless there is a shift in demand fundamentals, while Butane prices could remain stable, supported by petrochemical sector requirements. Crude Oil prices continue to influence and is expected to drive LPG price direction, with volatility remaining a key factor, overall, the market remains cautious and reactive, with price movements closely tied to broader energy trends and demand fundamentals.

Weekly crude oil market analysis :

Oil prices faced a downturn last week, with WTI closing at 72.94 USD per barrel and Brent at 76.85 USD per barrel, both reflecting a decline from the previous week. WTI dropped from 75.08 USD to 72.94 USD, a 2.8% decrease, indicating persistent bearish sentiment, while Brent fell from 78.85 USD to 76.85 USD, down 2.5%, as market uncertainties weighed on prices.

Key News items and the market effects

- According to BloombergNEF, global investment in low-carbon energy hit a record $2.1 trillion in 2024. However, the 11% year-over-year growth is significantly slower than the previous 25% growth rate, which raises concerns about long-term energy transition efforts, as it represents only 37% of the required investment to achieve net-zero emissions by 2050. So, oil and fossil fuels may remain in use for a significantly longer period than previously anticipated.

- A Scottish Court ruling deemed the approval of the Rosebank oil field and Jackdaw gas field unlawful. The decision, based on Scope 3 emissions considerations, has effectively halted two of the UK’s largest oil and gas projects indefinitely. This ruling highlights growing legal and environmental scrutiny in fossil fuel development, which could tighten future supply prospects, although some may argue that additional supplies from the UK would lead to an over-supply in the market.

- Ukraine’s military launched a drone attack on Russia’s fourth-largest refinery in Nizhny Novgorod, causing significant damage and halting operations at a 340,000 b/d refinery. The attack raises concerns over potential supply chain disruptions, adding geopolitical risk to oil markets; which definitely could spike oil prices upwards. Reports also suggest an attempted drone strike on a nuclear reactor, escalating fears of broader instability.

NLNG responds to Dangote LPG prices

The Nigeria LPG sector continues to exhibit an interesting trend; with LPG selling for as low as 19.9 in Lagos and 20.05 Million per 20MT at Stockgap depot in Port Harcourt, with reports suggesting that off-takers are selling for as low as 18.7 Million per 20MT. This seems to suggest that NLNG has ditched benchmarking international prices for LPG sales to the local market but is benchmarking Dangote prices, which has disrupted the market since December 2024. The big question is how much LPG is Dangote supplying the market , some say 20 percent, while some suggest as much as 45%. With this current trend, LPG importation from international suppliers would no longer be feasible as local prices make nonsense of it. We will continue to monitor the market, to see how it unfolds

LPG Retail Prices.

Retail LPG prices remained as low as N15,000/12.5kg in Lekki and other parts nationwide, as LPG depot prices continue to crash.

Visit the LPG forum to share local Retail prices and participate in the discussion.

0 Comment.