- 2758

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

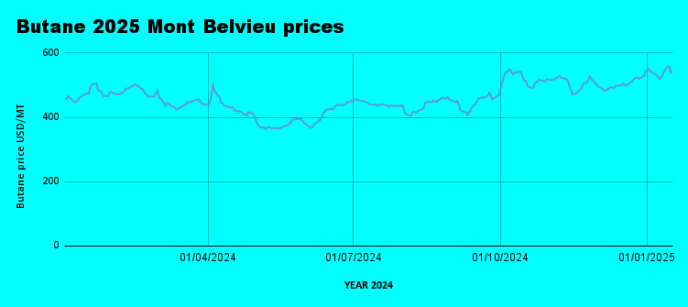

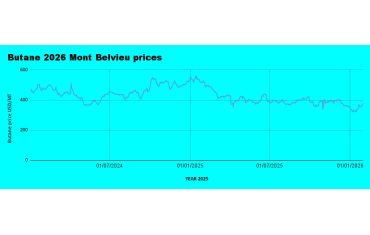

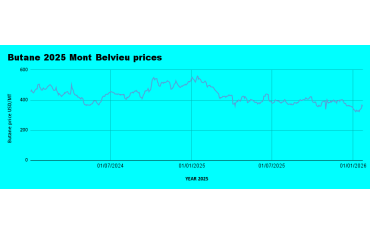

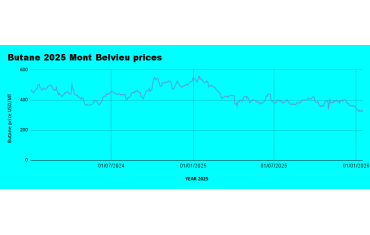

Weekly Mont Belvieu Propane-Butane Price Review: January 17th, 2025

Weekly Mont Belvieu Propane-Butane Price Overview: January 17th, 2025

Here’s a summary of this week’s LPG price trends, with daily average prices for propane and butane:

13/01/2024: Propane $470.9 / Butane $553.5

14/01/2024: Propane $480.9 / Butane $559.5

15/01/2025: Propane $503.1 / Butane $557.2

16/01/2025: Propane $504.4 / Butane $539.1

17/01/2025: Propane $510.4 / Butane $544.2

Overview

LPG prices continued their upward trajectory this week, with both propane and butane experiencing noticeable increases compared to the previous week’s averages of Propane: $456.1 per metric ton and Butane: $528.7 per metric ton.

Propane prices showed significant growth this week, increasing by $37.8 per metric ton on average; with a weekly average of $493.9 per metric ton, up 8.3% from last week . The rise reflects strong market demand and tight supply conditions.

Butane prices also increased, albeit more moderately, gaining $22.0 per metric ton over the week; with a weekly average of $550.7 per metric ton (up 4.2% from last week. The highest daily price for butane was recorded on 14/01/2025 at $559.5, followed by slight adjustments downward.

The price rally aligns with global market drivers such as elevated crude oil prices and seasonal demand in key markets.

Ongoing geopolitical developments and cold weather across Europe and North America have sustained bullish sentiment.

Outlook:

Prices are expected to remain elevated in the near term, driven by: Increased winter heating demand, Limited global inventory replenishment during peak consumption periods, and Volatility in crude oil markets. Monitoring developments in oil prices, supply chain dynamics, and geopolitical events will remain critical for understanding price trends in the coming weeks.

Weekly crude oil market analysis :

Crude oil prices closed the week at $78.25 and $80.71 per barrel for WTI and Brent, respectively, against the previous close of $77.46 and $80.36 per barrel in the previous week. This is a weekly increase of 1.02% and 0.44%, respectively, signifying a modest rise driven by geopolitical developments and supply-demand dynamics.

The ceasefire between Hamas and Israel brought relief to markets concerned about potential escalation in the Middle East. While the region remains geopolitically sensitive, the agreement alleviated immediate risks of oil supply disruptions from neighboring oil-producing regions;which dampened speculative upward pressure on crude prices. Also, OPEC+ production cuts continued to support prices, maintaining a floor despite broader uncertainties in global demand. In contrast, seasonal demand, driven by low temperatures in key markets, sustained a balanced market, preventing any significant price declines. Other factors include; optimism over China's demand recovery, though slower-than-expected economic data from the U.S. limited price gains.

The price rally reflects a bullish turn in crude markets, driven by a combination of supply-side constraints and demand-side optimism. Higher oil prices could incentivize increased production from non-OPEC+ players, potentially balancing supply-demand dynamics in the medium term.Prices are expected to remain firm as the market reacts to geopolitical developments, weather conditions, and China’s demand trajectory. Upcoming OPEC+ meetings and further updates on U.S. and Russian sanctions will remain pivotal for market direction.

Nigerian LPG Depot Prices continue to defy international prices

The Nigeria LPG prices continue to exhibit an interesting trend; with prices going as low as 20.3 Million per 20MT in Apapa from a low of 21.1 Million in the previous week, but rebounded to 21.5 Million before the end of the week. Dangote refinery prices continue to be a major factor pushing prices down, according to market intelligence.

Retail Prices

Retail LPG prices stayed around N15,250/12.5kg in Lekki, which aligns with the dropping LPG prices.

Visit the LPG forum to share local Retail prices and participate in the discussion.

0 Comment.