- 571

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

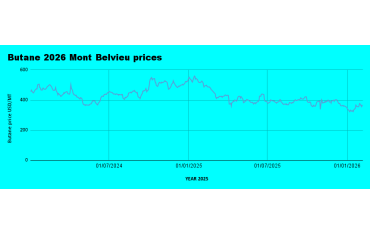

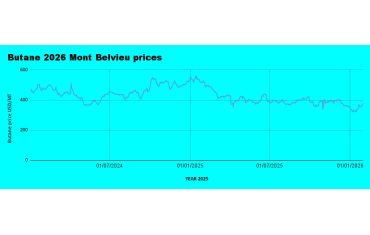

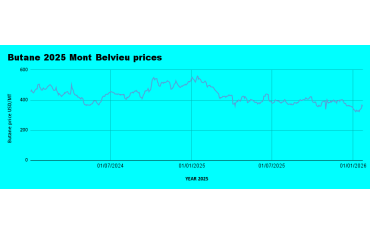

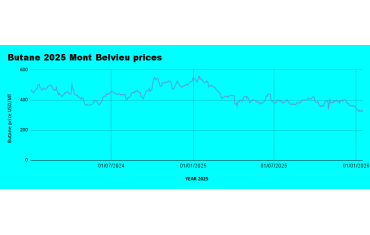

Weekly LPG Mont Belvieu And Nigerian LPG Price Review January 23rd 2026

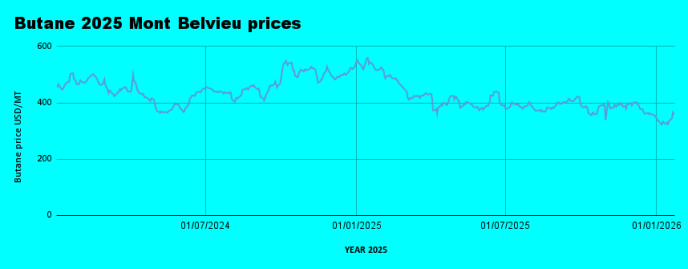

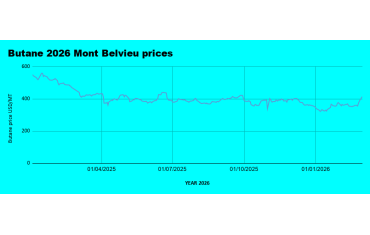

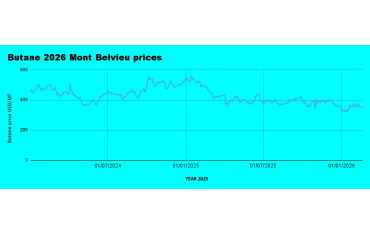

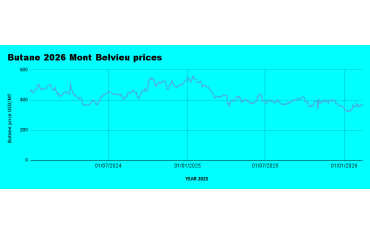

Weekly Mont Belvieu Propane–Butane Market Update – January 23rd, 2026

Weekly Average LPG Prices:

20/01/2026: Propane $315.5 | Butane $346.3

21/01/2026: Propane $340.9 | Butane $366.8

22/01/2026: Propane $339.3 | Butane $363.4

23/01/2026: Propane $337.0 | Butane $358.0

LPG Prices – Big jump in LPG prices

A big jump in prices was seen in both Propane and Butane prices, ending 5 weeks of bearish momentum. While there was a 7.4% increase in the average weekly price of Propane, Butane recorded a 9.4% jump in prices. As projected in the analysis last week , the rebound is in alignment with the rebound in crude oil prices. The US is also experiencing severe weather conditions, which hampers the transportation of LPG - this is also a factor in LPG price movement.

Propane: averaged $333.2/MT, down from $310.1/MT

Butane: averaged $358.6/MT, down from $327.7/MT

Crude Oil – Price rebound sustained on Geopolitical Developments

(WTI: $61.07 | Brent: $65.90)

Oil prices continue to respond to geopolitical events in Iran, as oil prices touch new recent highs. WTI closed at 61.07, while Brent closed the week at 65.90 USD per barrel. The location of the US naval fleet close to Iran has raised tensions and speculations of a US attack on Iran in response to the protests and news of extreme human rights abuses by the Iranian government.

The extreme cold conditions in the US and parts of Europe may also be a factor affecting prices, as refinery shutdown as a result of weather conditions. Also very notable is the supply disruptions at Kazakhstan, due to power supply issues, since January 18th, 2026 ( according to notable news sources ), with significant oil supply cuts.

Weekly Close:

WTI:$61.07 (up from $59.76)

Brent:$65.90 (up from $64.37)

Outlook:

Geopolitical events in Iran should be watched closely. We expect prices to drop when Kazakhstan crude supplies return to normal and weather conditions in the US and parts of Europe become friendly. The IEA increased its oil demand growth forecast for 2026 by 70,000 b/d, to 930,000 b/d, which is something to look at, as it's a factor to drive prices upwards during the year, relative to 2025.

Nigeria LPG Market – Domestic Prices fall to 16.45 million per 20MT in Apapa

Prices hit new lows in Apapa and Nationwide, as LPG prices hit 16.45 million per 20MT at A A Rano. There seems to be a lot of LPG in the market, which has kept prices down. However, we could see prices jump in response to international prices. As long as there are no LPG coming from Dangote refinery, which supplied about 500,000MT to the market in 2025, international prices will affect prices as offshore supplies ( NLNG and Import) are typically benchmarked by international prices.

See the LPG supply report for the Year 2025.

Retail Cooking Gas – Mixed Pricing Nationwide

Retail LPG prices remained uneven across locations, ranging between 1,050/kg and 1,300/kg nationwide. Further declines are likely in the coming weeks if depot prices continue their downward adjustment.

Kindly help assist us in answering these questions below to deepen our market research and to help the community grow better with much-needed information on challenges and opportunities. Click on the LINK to access the information.

- Lpg

- Lpgprices

- Lpgpricetrend

- Kazakstan

- Iran

- Usnavalfleet

- Iranprotest

- Dangoterefinery

- Oilprices

- Montbelvieuprices

- Domesticprices

- Domesticlpgprices

0 Comment.