- 2692

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

Weekly Mont Belvieu Propane-Butane Price Review: January 3rd, 2024

Weekly Mont Belvieu Propane-Butane Price Overview: January 3rd, 2025

Here’s a summary of this week’s LPG price trends, with daily average prices for propane and butane:

30/12/2024: Propane $408.0 / Butane $528.9

31/12/2024: Propane $420.7 / Butane $541.3

02/01/2025: Propane $441.5 / Butane $551.0

03/01/2025: Propane $450.7 / Butane $543.3

Notable upward movement in LPG prices

This week saw a notable upward movement in LPG prices, with propane and butane recording significant gains compared to the previous week. The bullish trend reflects increased market activity post-holidays and evolving global demand dynamics.

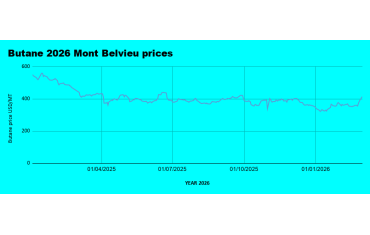

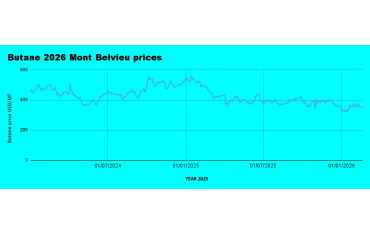

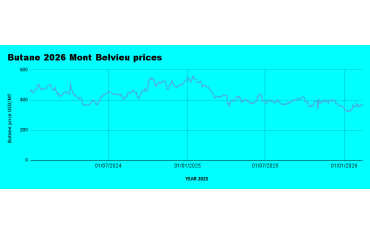

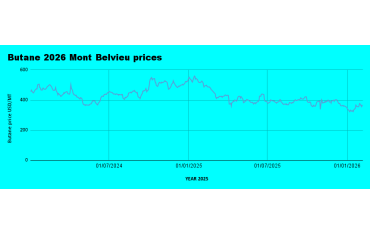

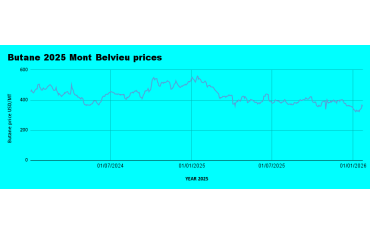

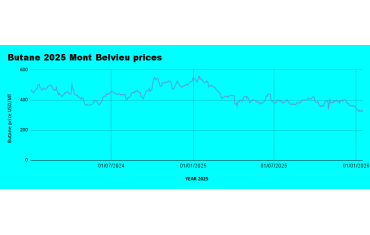

Weekly Price Trends

Propane: Averaged $430.2 per metric ton, an 8.4% increase from last week's average of $396.7.

Butane: Averaged $541.1 per metric ton, reflecting a 4.2% increase from last week's $519.4.

Propane Prices: The steep climb in propane prices this week suggests strong demand, potentially driven by increased heating needs in colder regions and inventory adjustments after the holiday season. The 11% rise from December 30 to January 3 highlights sustained upward momentum.

Butane Prices: Butane's more modest growth points to stable demand, likely supported by its role in blending and cooking gas applications. The price peaked at $551.0 on January 2, but a slight softening at the end of the week indicates market stabilization.

The current bullish trend could persist if global demand remains strong and winter heating needs continue to drive consumption. However, any changes in crude oil prices or inventory reports could temper the upward trajectory.

Weekly Crude Oil Market Analysis: Oil prices maintain strong bullish sentiment

Crude oil prices saw a bullish performance last week, with WTI closing at $73.27 and Brent at $76.02, marking significant gains compared to the previous week's closes of $70.13 and $73.72, respectively. This upward movement reflects improving market sentiment driven by geopolitical and economic developments.

Key Drivers

China's Economic Optimism: The announcement of special treasury bonds worth $411 billion to stimulate China's economy boosted global demand expectations. As one of the largest oil consumers, China's recovery optimism played a crucial role in driving prices higher.

Geopolitical Factors: Geopolitical tensions in key oil-producing regions provided additional support to oil prices, with concerns about potential supply disruptions. The potential for further sanctions on Russian energy exports also contributed to the bullish trend.

U.S. Crude Inventory Draw: Market expectations of a crude inventory draw in the U.S. fueled optimism. The actual data aligned with this sentiment, reducing fears of oversupply and reinforcing upward price momentum.

Seasonal Demand: Winter heating needs continued to bolster demand for crude derivatives, indirectly supporting crude oil prices.

Outlook

While the current bullish trend indicates positive momentum, the market remains sensitive to several factors:

- The trajectory of China's economic recovery and its energy demand.

- Upcoming OPEC+ production decisions and their implications for global supply.

- Continued monitoring of U.S. interest rate policy, as hawkish signals from the Federal Reserve could temper market optimism by dampening economic growth prospects.

In summary, last week’s price increases underscore a recovering oil market sentiment, with both WTI and Brent showing strong resilience. However, future price stability will depend on a delicate balance between demand growth and geopolitical uncertainties.

Nigerian LPG depot Prices drop further

Depot prices for LPG dropped further last week; In Apapa, prices hovered around 22.3 million Naira per 20 MT,it sold lower at some other depots. For the South-South region, Prices hovered around 23.8 Million per 20MT. Dangote continued to offer lower rates, with offtakers selling at 22.2 to 22.5 million Naira per 20 MT, below the market average. The drop in prices may be as a result of the holidays and less trading activities. We expect prices to return bullish after the holiday.

Retail Prices drop

Retail LPG prices also dropped in some states. In Lekki, LPG sold for 16,800 Naira per 12.5kg cylinder, a drop from N17,500 it sold last week.

Visit the LPG forum to share local Retail prices and participate in the discussion.

0 Comment.