- 3816

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

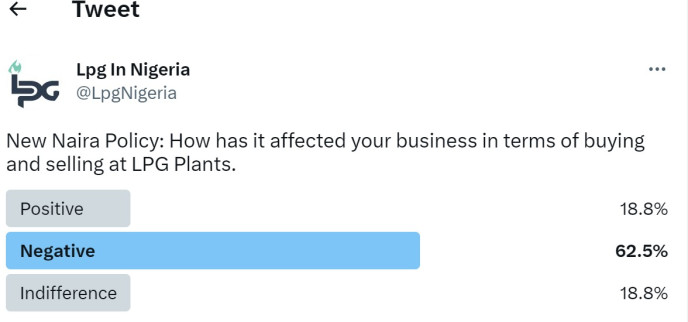

62.5% OF NIGERIANS SAY THE NEW NAIRA POLICY HAS NEGATIVELY IMPACTED THEIR LPG BUSINESSES.

Every business owner in Nigeria is either directly or indirectly affected by the country's new naira policy. It is not news that there has been a squabble over what the acceptable medium of payment was since January 31st, 2023. Many business owners, LPG business owners, and retailers have been impacted by the government's new Naira Redesign policy, which has a negative impact on businesses in a cash-dependent country like Nigeria. The implementation of the cashless policy has dealt a significant blow to Nigeria's LPG industry, which was already experiencing stunted growth due to high cooking gas prices.

Of course, LPG in Nigeria needed to hear from our customers and social media followers firsthand. According to our Twitter poll, 62.5% of our followers thought the naira redesign/cashless policy had a negative impact on the LPG industry. 18.8% see the impact as positive, while 18.8% are unconcerned about the changes taking place in the country and the LPG industry. According to survey respondents, the current acute scarcity of new naira notes has caused Nigerians to be very frugal with their spending, affecting their purchasing capacity and LPG business owners (LPG retailers in cash dependent areas/Unbanked areas).

New Naira Notes – The New Gold

Nigerians now prioritize their needs, with food, shelter, health, and transportation at the top of the list, and this has been the case for some time. According to our Facebook followers, with the unavailability of Naira (the new gold, if you ask us), LPG (cooking gas) is no longer a top priority for most Nigerians. Those on the outskirts of major cities, as well as residents of small towns and villages, who do not have pre-paid meters and have access to cheaper, if not sustainable, alternative sources of cooking fuel (dung, firewood, and kerosene) are taking it as a viable option.

Alternatives to Cooking Gas

Since there are less expensive, albeit unsustainable, alternative energy sources for cooking, such as firewood, dung, charcoal, and kerosene (which are all abundant and cheap during the current dry season). Nigerians with limited or no cash can avoid purchasing cooking gas or LPG. These Nigerians would rather use the money they spent on "expensive" cooking gas to meet other pressing needs, such as food and shelter.

Poor Online Banking Services

Inter-bank money transfer glitches have made many banked Nigerians wary of using the services, particularly when they are in a hurry. Some bank transfers have been reported to take several hours or days to reach the intended recipient. That is a risk that many LPG customers are unwilling to take, so they are turning to other options, such as public power and traditional cooking fuels.

All these factors contribute to dwindling patronage at the country's LPG terminals and refilling plants. As a result, making sense of our surveys' overwhelmingly negative responses.

From our end, we propose these recommendations:

The release of more Naira notes should be imperative and in circulation more. This will enable LPG users to purchase the product at their leisure.

Also, a major improvement in online banking services will stir up a substantial percentage of LPG users to avail themselves of that mode of payment to purchase cooking gas. We need the banking industry to do more because the current Nigerian situation has revealed how handicapped these banking apps are.

Finally, there is the recent Central Bank of Nigeria’s operational guidelines for open banking in Nigeria. Open banking is a financial services concept that allows third-party financial service providers to access banking data, typically through application programming interface (APIs), with the explicit consent of the customers. It basically allows customers to share their banking data with other financial service providers, enabling them to access a wider range of products and services. Although this new banking strategy seems like a “good” decision, it is necessary for financial institutions to take into cognizance the fraudulent actions that could affect customers and financial institutions as well. Data storage in the Nigerian financial institution is at best not well protected: having customers give their data information to third parties could be a stretch for security.

0 Comment.