- 713

- 2

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

Nigeria's Total LPG Supply Hit 1.6 Million Metric Tons In 2025

Nigeria LPG Supply Review – 2025

Nigeria's total LPG Supply hit 1.6 Million Metric Tons in 2025

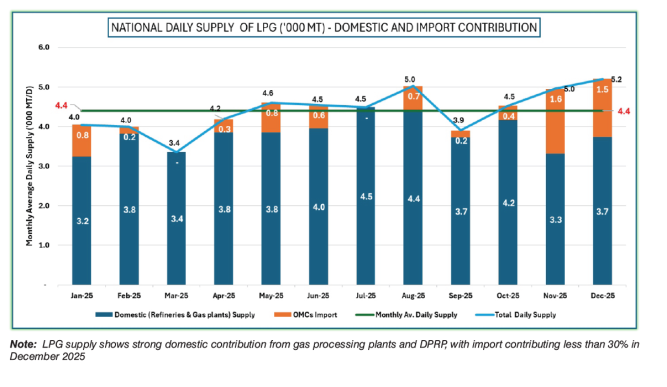

Nigeria’s LPG market reached a historic milestone in 2025, with total LPG supply estimated at 1.6 million metric tons, according to the NMDRPA December LPG report. This confirms Nigeria’s steady transition toward a more mature, domestically anchored LPG supply structure.

This post shares highlights from the NMDPRA report and our Offshore supply data gathered from the field.

1. Marine vs Inland Supply Structure

Offshore / Marine-Based Supplies (Coastal Receipts)

Offshore/ Marine receipts captured from depot and vessel data account for approximately 702,000 MT

Major sources of LPG include:

- NLNG

- NNPC Trading

- BRT Bonny / Seplat

- Imported Cargoes

- Other sources include the Dangote Refinery and in-country Inland Gas Processing Plants.

The volume supplied in the country was approximately 898,000 MT, i.e., non-offshore.

This means over 56% of Nigeria’s LPG supply in 2025 originated from Dangote Refinery and Inland Gas processing plants, confirming a major structural shift in LPG supply dependence.

While exact inland plant volumes are not yet publicly disaggregated, available market intelligence confirms that Dangote Refinery is currently the largest inland LPG supplier, followed by Kwale Hydrocarbon Processing Plant. Other contributors include Panocean (Ovade), PNG (Umutu), Greenville, and Green Energy in Port Harcourt.

2. Import vs Domestic Supply

Based on compiled marine and inland flows:

- Domestic supply: ~86.7%

- Imports: ~13.3%

This represents Nigeria’s lowest LPG import dependence on record, highlighting improved energy security, FX savings, and supply resilience. Domestic LPG supply dominance has kept prices relatively low. Prices started high, at about 20 million Naira per 20MT, and have dropped to about 17 million currently.

3. Breakdown of Offshore Supply Sources (Marine Receipts)

Among marine-based flows, supply was dominated by:

- NLNG: ~338,092 MT

- Imports : ~198,500 MT

- NNPC Trading: ~110,700 MT

- BRT Bonny: ~56,245 MT

- Seplat / BRT: ~12,000 MT

NLNG remains the single largest marine supplier, but its dominance continues to decline relative to inland production growth and, of course, market growth.

4. Regional Supply Distribution

Depot receipts show a strong regional imbalance:

- South West: ~523,000 MT

- South South: ~179,000 MT

This indicates that South-South depots remain structurally underutilized, despite being closer to many gas processing assets. Logistics, trucking economics, and market depth continue to favor Lagos-centric distribution. This could be due to the emergence of Dangote Refinery and the continued dominance of Kwale Hydrocarbon in terms of LPG volumes.

5. Top Receiving Depots in 2025

DepotApprox. Volume

NAVGAS ~151,466 MT

NIPCO ~145,737 MT

STOCKGAP ~144,400 MT

ARDOVA ~95,579 MT

RAINOIL ~61,000 MT

These five depots alone handled a significant share of Nigeria’s marine LPG receipts, reinforcing Apapa’s dominance in LPG logistics. Others in the South South are Matrix Energy and A Y Shafa.

RegionSum of Quantity (MT)

South-West 529,182

South-South 179,155

Grand Total 708,337

6. Supply Characteristics & Operational Patterns

Vessels mostly used include MT ALFRED TEMILE, MT ALFRED TEMILE 10, MT BARUMK GAS, and MT SAPET GAS. Others include MT AFRICAN GAS, MT LPG QUEBEC, MT VAROLI PIAZZA, and a few more.

Timing: Marine supplies were uneven and largely opportunity-driven, where there were supply lapses from Dangote Refinery, while inland supplies provided a more consistent flow.

Prices were directed mainly by the inland supply, which acted as a price-stabilizing anchor for the market.

7. Strategic Market Implications

Nigeria has effectively crossed into a domestically driven LPG market.

Import reliance has structurally reduced, lowering FX exposure.

Inland production is now the backbone of supply growth.

Dangote Refinery and Kwale Hydrocarbon will increasingly shape the national LPG price direction if this trend continues.

Regional imbalance remains a logistics challenge, especially for South-South utilization.

8. Conclusion

With 1.6 million MT of LPG supplied in 2025, Nigeria has not only set a new consumption record but has also achieved a major supply transition milestone. The market is no longer import-led; it is now inland-anchored, refinery-supported, and gas-processing driven. With upcoming Gas projects, including the Flare Gas Commercialisation Program, we expect more inland LPG supplies in the near to immediate term.

As inland production continues to expand and logistics improve, Nigeria is positioned to sustain long-term LPG growth with improved price stability, stronger energy security, and greater investor confidence.

- Nmdpra

- Nlng

- Brt

- Seplat

- Bonny

- Dangote

- Nipco

- Stockgap

- Navgas

- Rainoil

- Sapet

- Alfredtemile

- Alfredtemile10

- Bamuk

- Africangas

- Varolipizza

- Mtlpgquebec

- Consumption

- Nigerialpg

- Nigerialpgconsumption

- Lpgsuppies

- Lpgprice

Yahaya Auwal

18 January 2026 - 09:20pmVery Interested this year

Reply