- 1324

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

Weekly LPG Mont Belvieu And Nigerian LPG Price Review November 14th 2025

Weekly Mont Belvieu Propane-Butane Market Update – November 14th, 2025

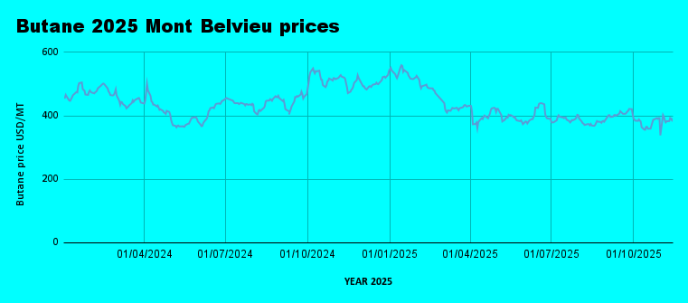

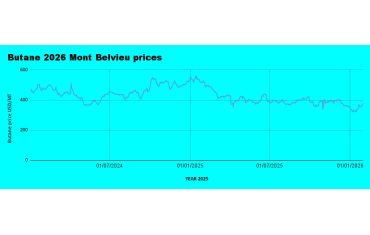

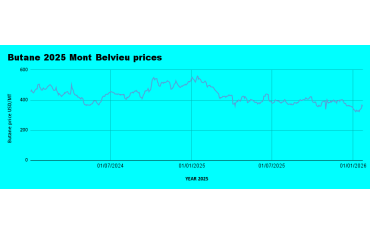

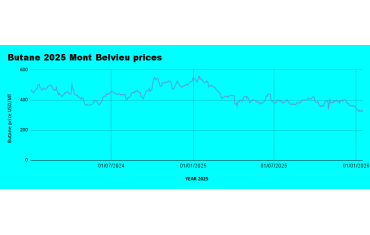

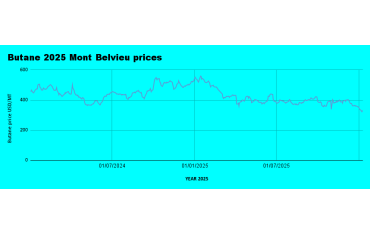

Weekly Average LPG Prices:

10/11/2025: Propane $307.4 | Butane $383.4

11/11/2025: Propane $320.6 | Butane $393.0

12/11/2025: Propane $318.5 | Butane $390.7

13/11/2025: Propane $313.4 | Butane $386.2

14/11/2025: Propane $312.3 | Butane $392.1

LPG Prices Hold Flat, With No Clear Direction

Global LPG prices were largely directionless this week, with both Propane and Butane showing minimal movement and no strong trend emerging.

Propane: averaged $314.4/MT, up 1.5% from last week’s $309.9/MT.

Butane: averaged $389.1/MT, down 0.1% from last week’s $389.4/MT.

Crude Oil – Prices Still Range-Bound (WTI: $60.09 | Brent: $64.39)

Crude oil continued to trade sideways, maintaining a tight price range. Even the Ukrainian drone strike on Russia’s largest Black Sea oil port—Novorossiysk, which temporarily halted exports—failed to influence market direction.

Fresh monthly reports from IEA and OPEC reinforced concerns about oversupply, strengthening bearish sentiment across the oil market. We will continue to track developing fundamentals closely.

Weekly Close:

WTI: $60.09 (up from $59.72)

Brent: $64.39 (up from $63.64)

Outlook: A sub-$60/barrel scenario remains realistic in the medium term, given the oversupply highlighted in both OPEC and IEA market assessments.

Nigeria LPG Market – Surprising Turn as Dangote Refinery Re-enters the Market

Nigeria’s LPG market opened up dramatically this week following an unexpected resumption of LPG sales from Dangote Refinery, combined with fresh cargo arrivals at multiple Lagos depots.

Prices around the refinery dropped sharply from about ₦19.4 million to ₦17.5 million per 20MT, with some deals even lower, triggering ripple effects across the value chain. More expensive imported cargoes now face potential losses due to competitive pressure from Dangote’s lower prices.

While it may take another week for these changes to reflect nationwide, the expectation of a “Red December” on the demand side has shifted. Instead:

Upstream players may face margin pressure. Downstream players, retailers, and bottling plants stand to benefit from improved margins as lower depot prices meet robust festive-season demand.

Apapa and other Southwest depots still traded above ₦18 million, but significant downward adjustments are expected across other depots in the coming week.

Retail Cooking Gas – Prices Stable Despite Oversupply Signals

Retail LPG prices remained largely steady across Nigeria, with no major declines yet, despite the growing oversupply at the wholesale level.

Prices are expected to soften after the Yuletide season, once the market fully absorbs new supply volumes.

0 Comment.