- 1165

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

Weekly LPG Mont Belvieu And Nigerian LPG Price Review October 31st 2025

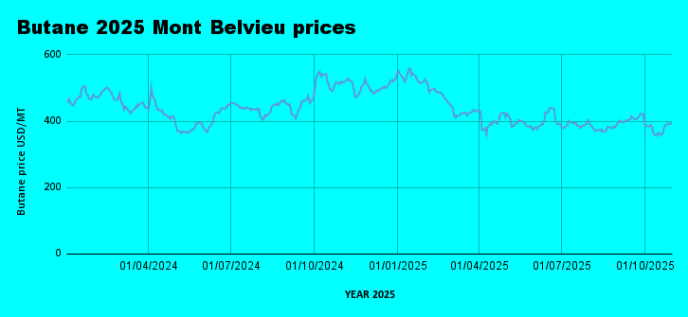

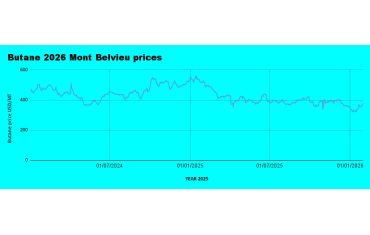

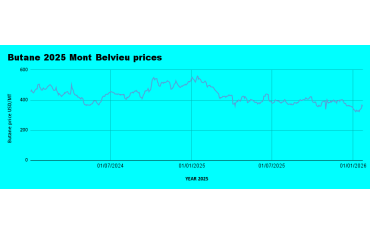

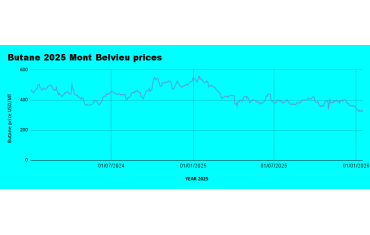

Weekly Mont Belvieu Propane-Butane Market Update – October 31st, 2025Weekly Average LPG Prices:

27/10/2025: Propane $338.6 | Butane $392.6

28/10/2025: Propane $337.5 | Butane $390.4

29/10/2025: Propane $339.1 | Butane $392.8

30/10/2025: Propane $338.6 | Butane $392.7

31/10/2025: Propane $336.9 | Butane $395.5

LPG Prices Extend Bullish Momentum for Second Consecutive Week.

LPG prices continued their upward trajectory for the second straight week, closing strongly with notable increases in weekly averages for both propane and butane. Seasonal demand factors are beginning to influence the market, with colder temperatures driving heating needs across key consuming regions.

Propane: averaged $338.2/MT, up 4.8% from last week’s $322.7/MT.

Butane: averaged $392.8/MT, up 4.4% from last week’s $376.4/MT.

Crude Oil – Market Holds Flat Amid Mixed Fundamentals

Crude oil prices ended marginally lower on Friday, showing muted reaction to US-China discussions on potential increases in OPEC+ production. Meanwhile, renewed US sanctions on Russian crude have yet to meaningfully influence price direction—signaling a cautious, potentially bearish outlook.

WTI: $60.98 (down from $62.17)

Brent: $64.77 (down from $66.47)

Outlook: A sub-$60/barrel environment remains a realistic scenario in the medium term, with market sentiment weighed by economic uncertainty and ongoing monitoring of the Russia-Ukraine situation.

Nigeria LPG Market – Tight Supply, Rising Demand Pressures Continue

Nigeria’s domestic LPG market remains strained, with depot pricing diverging and supply shortfalls persisting. Limited vessel arrivals and slow truck loading have contributed to the upward pressure. While Apapa sold for circa 18.5 Million per 20MT , Panocean and KHNL sold at the same - 18.5 Million , but offtakers at Stockgap Depot sold for circa 20 Million per 20MT. Loading at Dangote Refinery continues as marketers struggle to load product they purchased weeks ago - it was a similar situation at NAVGAS depot; information from a follower on twitter showed a long queue of trucks waiting for days to load product purchased.

Retail Cooking Gas – Prices Yet to Flare Despite Market Pressure

Retail cooking gas prices largely held steady nationwide, as plant operators maintained last week’s selling levels. However, this stability is fragile and may reverse quickly without new LPG imports or improved loading timelines. Consumers should brace for possible upward adjustments if supply constraints persist into the coming week.

Lekki: 1,300/kg

Ikorodu: 1,300–1,500/kg

Port Harcourt: around 1,500/kg

Katsina: 1,300 - 1,500/kg

The global LPG market remains bullish, while Nigeria’s domestic supply constraints are amplifying the trend locally. Unless import volumes and refinery load-outs improve rapidly, retail prices may begin reflecting the tightening fundamentals, again - soon.

- Lpg

- Butane

- Propane

- Lpgnigeria

- Nigerialpg

- Lpgpricetrend

- Lpgtrend

- Lpgmarkets

- Trump

- China

- Russia

- Ukraine

- Sanctions

- Winter

- Nigeriadepot

- Navgas

- Stockgap

- Panocean

- Khnl

- Dangote

- Loadingdepot

- Cookingprice

- Retailprice

0 Comment.