- 1008

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

Weekly Mont Belvieu Propane-Butane Market Update – November 7th, 2025

Weekly Mont Belvieu Propane-Butane Market Update – November 7th, 2025

Weekly Average LPG Prices:

03/11/2025: Propane $325.9 | Butane $402.3

04/11/2025: Propane $317.8 | Butane $396.5

05/11/2025: Propane $303.8 | Butane $386.0

06/11/2025: Propane $298.3 | Butane $379.4

07/11/2025: Propane $303.5 | Butane $382.8

LPG Prices Reverse Course

Global LPG prices reversed direction this week, with Propane prices falling to their lowest level in over two years. The sharp decline in propane may be linked to falling crude oil prices, which have made naphtha—a competing feedstock for the petrochemical industry, more attractive.

However, as colder temperatures set in across the Northern Hemisphere, LPG demand is expected to strengthen, potentially providing some support to prices in the coming weeks.

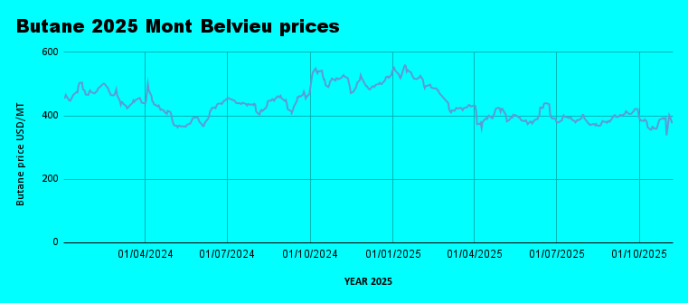

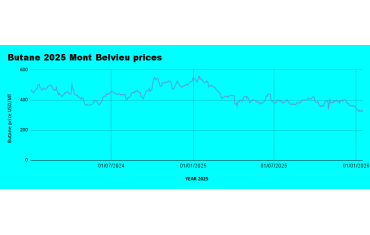

Propane: averaged $309.9/MT, down 8.4% from last week’s $328.2/MT.

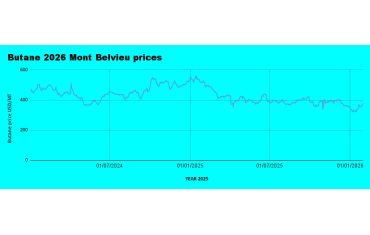

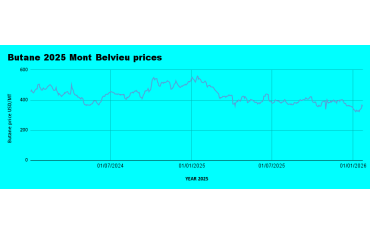

Butane: averaged $389.4/MT, down 0.9% from last week’s $392.8/MT.

Crude Oil – Hardly Unmoved Amid Mixed Fundamentals

Crude oil prices closed marginally lower week-on-week, as persistent concerns of oversupply continued to weigh on sentiment.

OPEC+ production increased in October as key members resumed previously halted output, while non-OPEC producers also ramped up supply. In response to the well-supplied market, Saudi Arabia, the world’s largest exporter, cut its December crude prices for Asian buyers.

On the geopolitical front, US restrictions on Russian crude exports and the ongoing Ukraine–Russia conflict continue to pose potential supply risks.

WTI: $59.72 (down from $60.98)

Brent: $63.64 (down from $64.77)

Outlook: A sub-$60/barrel environment remains plausible in the medium term, with bearish sentiment fueled by economic uncertainty and close monitoring of global supply dynamics.

Nigeria LPG Market – Tight Supply, Limited Price Movement

Nigeria’s domestic LPG market remained tight during the week, with limited stock availability at major depots. Lagos faced noticeable supply strain, while KHNL and Panocean depots in the Delta region sold product at around ₦18 million per 20MT.

Depot sources indicate that new supplies are expected into Ardova, NAVGAS, NIPCO, and A.A. Rano depots in the coming week, which could ease the pressure and stabilize prices across regions. Prices are expected to hover around ₦18 million as supply gradually meets demand ( With the temporary LPG sales break at Dangote Refinery).

Retail Cooking Gas – Prices Steady Despite Tight Supply

Retail prices showed minimal changes nationwide despite ongoing supply constraints. Some locations reported slight drops in prices, while others remained elevated. Ikeja stood out with the highest price during the week at ₦1,600/kg.

Prices are expected to soften slightly in the coming week as new depot supplies arrive.

Lekki: ₦1,300/kg

Ikeja: ₦1,600/kg

Ikorodu: ₦1,400–₦1,500/kg

Port Harcourt: ~₦1,440/kg

Katsina: ₦1,300–₦1,500/kg

- Lpg

- Butane

- Propane

- Lpgtrend

- Lpgpricetrend

- Montbelvieu

- Lpgsupply

- Nigerialpg

- Trump

- Russia

- Ukraine

- Crude

- Winter

- Wti

- Brent

- Dangoterefinery

- Khnl

- Panocean

- Apapa

- Navgas

- Ardova

- Nipco

0 Comment.