- 3079

- 0

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

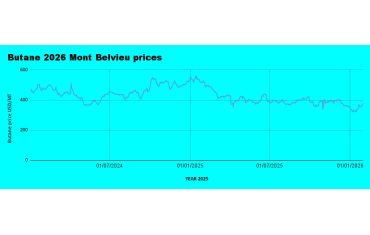

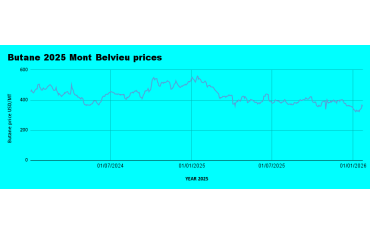

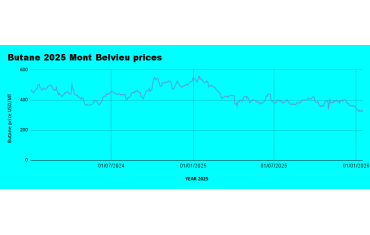

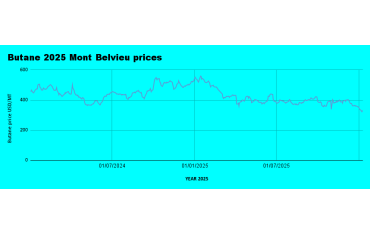

Weekly Mont Belvieu Propane-Butane Price Review: December 27th, 2024

Weekly Mont Belvieu Propane-Butane Price Overview: December 27th, 2024

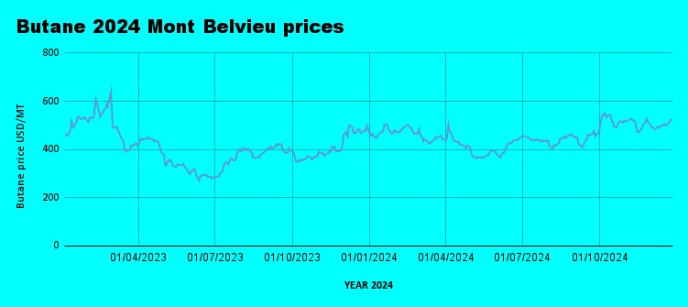

Here’s a summary of this week’s LPG price trends, with daily average prices for propane and butane:

23/12/2024: Propane $393.0 / Butane $512.5

24/12/2024: Propane $396.3 / Butane $521.8

26/12/2024: Propane $397.4 / Butane $523.6

27/12/2024: Propane $400.0 / Butane $519.8

LPG Mont Belvieu Prices Show strong bullish tendencies

Comparing the provided data with the previous week’s performance reveals slight volatility in LPG prices, with varying trends for propane and butane:

Propane and butane prices continued their upward trajectory this week, reflecting steady market activity as the year draws to a close.

Propane prices averaged $396.7 per metric ton, marking a 0.7% increase from last week’s average of $394.0 per metric ton. This steady climb reflects stable demand and minimal supply disruptions during the holiday season.

Butane prices averaged $519.4 per metric ton, showing a 3.3% increase compared to the previous week’s $503.0 per metric ton. The price peak on December 26, at $523.6 per metric ton, indicates robust demand, likely driven by seasonal heating and year-end consumption needs. While propane prices maintained a modest increase, butane showed a more pronounced rise, suggesting stronger demand pressures. The average weekly gains for both products underline the market's resilience despite broader economic uncertainties. With propane showing incremental growth and butane demonstrating more volatility, the market is likely to remain dynamic. Attention will shift to factors such as post-holiday demand, weather forecasts, and geopolitical developments, which could further influence price directions.

Weekly Crude Oil Market Analysis: Oil Sentiment turns bullish

Overview of Last Week’s Prices

Crude oil prices rebounded last week, fuelled by a mix of bullish economic signals and anticipated inventory reductions in the United States.

WTI: Closed at $70.13 per barrel, marking a notable recovery from previous lows.

Brent: Closed at $73.72 per barrel, reflecting growing market optimism.

Key Drivers of Price Movement

China’s Economic Stimulus

The Chinese government's decision to issue special treasury bonds worth approximately $411 billion injected fresh optimism into the markets. This move is expected to boost infrastructure spending and domestic consumption, signaling stronger oil demand from the world’s largest crude importer.

U.S. Crude Draw Expectations

Market sentiment turned more bullish as traders anticipated a significant draw in U.S. crude inventories. A reduction in stockpiles typically indicates robust demand and tighter supply, which supports higher prices.

Seasonal Factors

The year-end often sees a seasonal uptick in energy demand, especially in colder regions. This trend, combined with the broader macroeconomic optimism, added to the upward pressure on oil prices.

Week-on-Week Analysis

WTI: Last week’s close at $70.13 per barrel represents a 1.5% increase from the prior week’s $69.1 per barrel. The break above the psychological $70 mark is a positive signal for traders, suggesting renewed momentum.

Brent: Closing at $73.72 per barrel, Brent saw a 1.5% rise compared to its previous close of $72.60 per barrel, consolidating its position in the low-$70s range.

Outlook for the Coming Week

China’s Influence

Further clarity on China’s bond issuance and its impact on economic activity could continue to drive bullish sentiment. Any signs of stronger oil imports or industrial growth would support higher prices.

Inventory Data

Traders will closely watch the upcoming U.S. crude inventory report. A larger-than-expected draw could propel prices further upward, while a surprise build may dampen optimism.

Geopolitical Factors

Ongoing geopolitical tensions in key oil-producing regions, particularly the Middle East and Russia-Ukraine, remain wildcard influences on price stability.

OPEC+ Production Strategies

Markets are also eyeing the upcoming OPEC+ meeting. If the group signals further restraint in production, it could lend additional support to prices.

Conclusion

The current price trajectory suggests a cautiously optimistic market. With key economic and inventory data expected in the coming days, oil prices could see continued volatility but remain broadly supported in the short term.

Nigerian LPG Depot Prices dropped slightly

Depot prices for LPG dropped slightly last week; In Apapa, prices hovered around 22.6 million Naira per 20 MT, it sold lower at some other depots. For the South-South region, Prices hovered around 24 Million per 20MT, with Shafa and Stockgap depots selling at approximately 24 million Naira. Dangote continued to offer lower rates, pricing at 22.2 million Naira per 20 MT, below the market average. The downward trend in prices is likely tied to the seasonal lull in trading activity. However, with the holiday season concluding, market dynamics are expected to shift, potentially driving prices upward in the coming weeks.

Retail Prices Remain Steady

Retail LPG prices held stable nationwide, supported by adequate market supply. In Lekki, LPG sold for 17,500 Naira per 12.5kg cylinder.

Visit the LPG forum to share local Retail prices and participate in the discussion.

- Lpg

- Butane

- propane

- Montbelvieu

- Pricetrend

- Depotprices

- Nigerialpg

- Nigerialpgdepot

- Shafa

- Prudentenergy

- Nipco

- 11plc

- Stockgapdepot

- Portharcourt

- Crudeoil

- Wti

- Brent

- Chinese

- Demand

0 Comment.