- 2938

- 1

Sharing Ideas and Updates on LPG in Nigeria and related information to enable effective collaboration within the LPG Value Chain

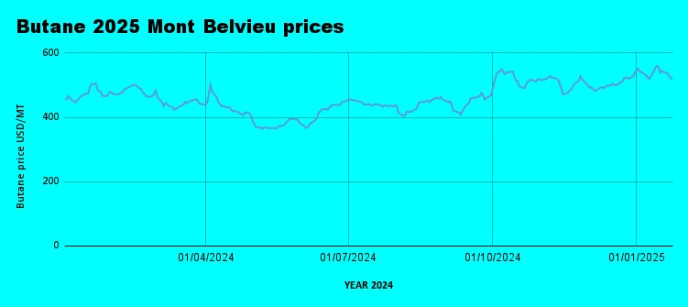

Weekly Mont Belvieu Propane-Butane Price Review: January 24th, 2025

Weekly Mont Belvieu Propane-Butane Price Overview: January 24th, 2025

Here’s a summary of this week’s LPG price trends, with daily average prices for propane and butane:

21/01/2024: Propane $485.8 / Butane $535.8

22/01/2024: Propane $482.1 / Butane $526.5

23/01/2025: Propane $483.4 / Butane $522.5

24/01/2025: Propane $481.8 / Butane $517.1

Overview

Propane and butane prices showed a slight downward trend this week compared to the previous week’s average. The market appeared to stabilize after prior weeks of fluctuating prices.

Propane prices averaged $483.3 per metric ton; down from last week's $494.0, reflecting a 2.2% decrease, which could be attributed to a balanced global supply and slower seasonal demand as winter peaks.

Butane prices averaged $525.5 per metric ton; down from last week's $538.7 average, marking a 2.4% decrease week-on-week. This softening may signal reduced demand for heating applications and industrial usage.

Prices will likely remain range-bound in the coming weeks, driven by a moderation in seasonal demand, Stable global LPG supply levels, and Potential geopolitical developments that could impact energy markets. Close monitoring of international LPG prices and related crude oil trends will be crucial in assessing price trajectories in the short term.

Weekly crude oil market analysis :

Crude oil prices experienced a decline during the week, with WTI closing at $75.08 and Brent at $78.85, compared to the previous week’s closes of WTI at $78.25 and Brent at $80.71. This marks a 4.1% drop for WTI and a 2.3% drop for Brent, reflecting bearish sentiment in the market amid political and economic developments.

Factors responsible for the trend include Trump’s rhetoric; his critical statements about U.S. foreign energy dependence and his calls for more domestic energy production have generated a ripple across the market. His comments highlighted uncertainty about future policy directions, influencing investor sentiment and weighing on crude oil prices. The ceasefire agreement between Hamas and Israel eased geopolitical tensions in the Middle East and has also reduced pressure on prices. This de-escalation helped reduce the risk premium factored into oil prices, contributing to the weekly decline.

Other factors include concerns over China’s sluggish economic recovery continue to loom large, as the world’s second-largest oil consumer struggles with weaker-than-expected industrial output and fuel demand. Despite Beijing's stimulus efforts, market participants remain skeptical of a robust rebound in the near term. And, lastly, warmer-than-expected winter temperatures across major consuming regions, particularly in Europe and North America, reduced demand for heating fuels, further softening crude oil prices.

Oil prices may face continued pressure in the near term as demand concerns persist, especially with China's economic uncertainty and limited cold-weather fuel demand. However, any unexpected geopolitical events or changes in OPEC+ strategies could lead to price volatility. Market participants will closely monitor U.S. inventory data and global economic indicators in the coming weeks.

Nigerian LPG Depot Prices hit new lows

The Nigeria LPG sector continues to exhibit an interesting trend; with prices hitting new lows and selling for as low as 20 Million per 20MT in Apapa from a low of 20.3 Million in the previous week. Dangote refinery prices continue to be a major factor pushing prices down, selling for as low as 18.9 Million by off-takers, according to market intelligence. Prices currently don't make sense when you factor in the cost of landing when LPG is imported.

Retail Prices unmoved.

Retail LPG prices stayed around N15,250/12.5kg in Lekki and unmoved in most locations nationwide.

Visit the LPG FORUM to share local Retail prices and participate in the discussion.

- Lpg

- Butane

- Propane

- Mont

- Belvieu

- Depot

- Apapa

- South

- Nigeria

- weeklytrend

- Pricetrend

- Us

- Trump

- China

- Crudeoil

- Wti

- Brent

Gabriela

27 May 2025 - 09:11pmRegards, Quite a lot of knowledge! casino en ligne Many thanks. Lots of tips. casino en ligne France Kudos. Ample information! casino en ligne France Excellent facts Thanks a lot! casino en ligne France Really all kinds of beneficial info. casino en ligne France Wow all kinds of helpful facts. casino en ligne Wow many of fantastic info. casino en ligne Awesome tips Regards. casino en ligne Perfectly spoken genuinely. . casino en ligne You actually said that well! casino en ligne fiable

Reply